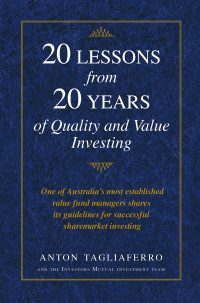

20 Lessons from 20 Years

Anton Tagliaferro

Many investors find navigating the sharemarket a daunting task as the market continues through its unpredictable cycles.

Each boom brings a new fad or theme that excites investors who are bombarded by hype in the media. During these times, some companies reach extreme valuations, as investors get caught up in the froth and bubble.

Inevitably, these often-irrational booms are followed by sharp corrections as reality catches up. High-quality stocks are not immune to market corrections but good-quality businesses, generating real earnings, tend to recover better over time and as calm is restored to markets.

Investors Mutual Limited’s (IML) quality and value investment philosophy is based on the premise that a company’s share price will reflect its underlying value over the long-term. IML employs an active research-driven approach to identify companies that meet IML’s quality criteria and then determine an appropriate valuation.

Following this approach since 1998, IML’s funds have experienced returns that are more consistent and less volatile than the Australian sharemarket.

The sharemarket will continue to evolve, and while this book is not meant to be a complete guide to investing in the sharemarket, hopefully, these lessons, which cover how IML has invested over the past 20 years, will be of value to investors over the next 20 years.